Bitcoin is on the verge of exploding, and many people will miss out because they doubted it. Bullish signals cannot be ignored, and there are numerous reasons to believe that Bitcoin is about to surge, potentially pulling the entire crypto market along with it. What are those bullish signals?

Bitcoin Technical Analysis: Indicators Suggest an Upcoming Rally

Bitcoin could surge around the end of Q3. All Bitcoin technical analyses show this, highlighting multiple bullish signals that traders cannot overlook. Below, we present various price patterns and analyses of Bitcoin for you to verify these signals yourself:

Cup and handle pattern: The Cup and Handle pattern observed in Bitcoin’s chart is a bullish technical formation characterized by a rounded bottom (the cup) followed by a smaller consolidation (the handle). This pattern suggests a period of accumulation, potentially leading to a breakout above the handle’s resistance level. For Bitcoin, analysts currently note resistance in the lower $70,000 range. If Bitcoin manages to break above this level, it could signal a significant upward movement, as the pattern traditionally forecasts.

Bollinger Bands: In the world of Bitcoin, historical patterns often provide valuable insights. Recent analysis indicates that whenever Bitcoin (BTC) approaches the lower band within the Bollinger Bands, it typically experiences a strong rebound, even in bearish market conditions. Currently, Bitcoin has once again touched the lower band, suggesting a potential opportunity for a significant bounce in the near term. This observation underscores the significance of technical indicators like Bollinger Bands in predicting potential price movements in the cryptocurrency market.

Wyckoff Reaccumulation: In this case, Bitcoin’s chart displays a Wyckoff Reaccumulation pattern, with a recent “spring” marking a crucial point suggesting potential upward movement. Unlike accumulation, reaccumulation occurs after a significant price advance and involves consolidating at higher levels before another potential upward move. Currently, Bitcoin is in the lower range of this reaccumulation phase and may soon head towards the upper range. A breakout above this zone could indicate a bullish continuation, potentially leading Bitcoin into a new phase of price discovery.

RSI bullish divergence: In the short term, Bitcoin’s chart shows a bullish divergence in the Relative Strength Index (RSI), a technical signal worth noting. While Bitcoin’s price is trending lower, the RSI is displaying signs of upward strength. This divergence suggests that despite Bitcoin’s price decline, selling momentum is weakening and could indicate a potential reversal to the upside in the near future. Technical analysts often interpret this discrepancy as a potential hint of a change in price direction.

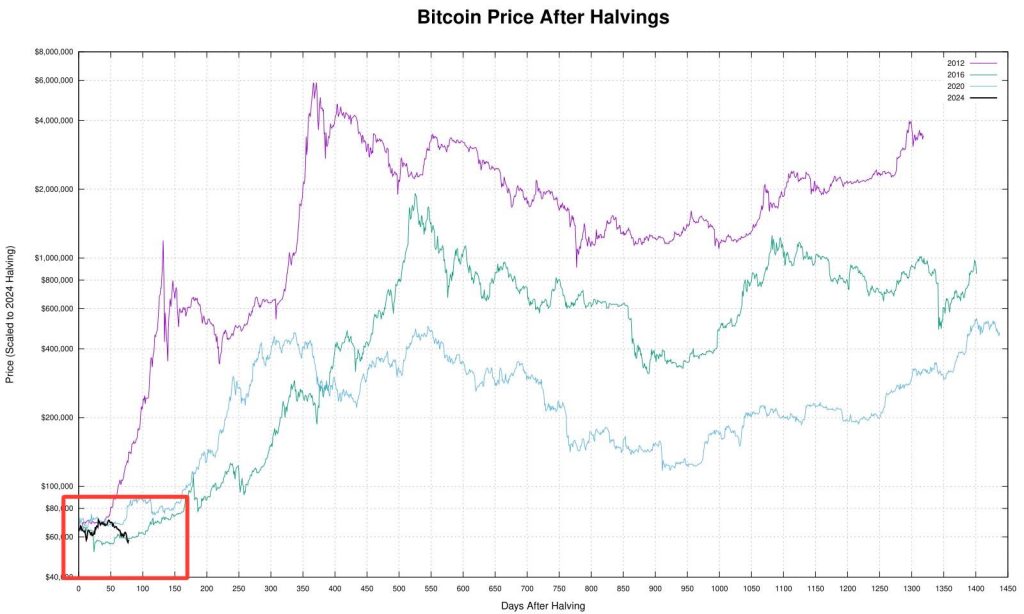

Cycle chart comparison: After each Halving event, Bitcoin has historically exhibited a notable price behavior characterized by a parabolic movement in the months following. This trend suggests a significant bullish trajectory rather than a bearish sentiment. The Halving reduces the rate at which new Bitcoins are created by half approximately every four years. It is designed to control inflation and has consistently triggered periods of heightened price appreciation in Bitcoin’s history. This cyclical pattern underscores a narrative where the supply-demand dynamics favor higher prices post-Halving, making a bearish outlook seemingly contradictory given Bitcoin’s historical price performance following these events.

Conclusion: The True Bull Run Is Just Around the Corner

As evidenced by the multitude of indicators suggesting that the crypto market is on the verge of exploding, it’s clear that Bitcoin will surge at some point in the coming months, catching many off guard. This surge will likely propel all altcoins, such as NOVA Real Chain, to significant price increases, filling investors’ pockets. The moment is drawing nearer, requiring only a bit of patience.

Unique investment opportunities in the crypto space are on the horizon, presenting lucrative prospects in trending sectors like memecoins and RWA (Real-World Assets) projects. Follow NOVA Real Chain to stay informed about these unique opportunities!