As Bitcoin once again approaches its all-time high, crypto enthusiasts and investors are monitoring the market for signs of a shift. Bitcoin’s recent momentum has drawn substantial attention, particularly from institutional investors, while retail interest remains relatively muted. This unique market dynamic has fueled speculation around an impending “altseason” — a period when alternative cryptocurrencies, or altcoins, often experience substantial growth. Here, we delve into the potential effects of Bitcoin’s trajectory on altcoins and what a thriving altseason could mean for emerging blockchain projects.

Bitcoin Soars with Unprecedented Institutional Demand: What’s Driving the Surge?

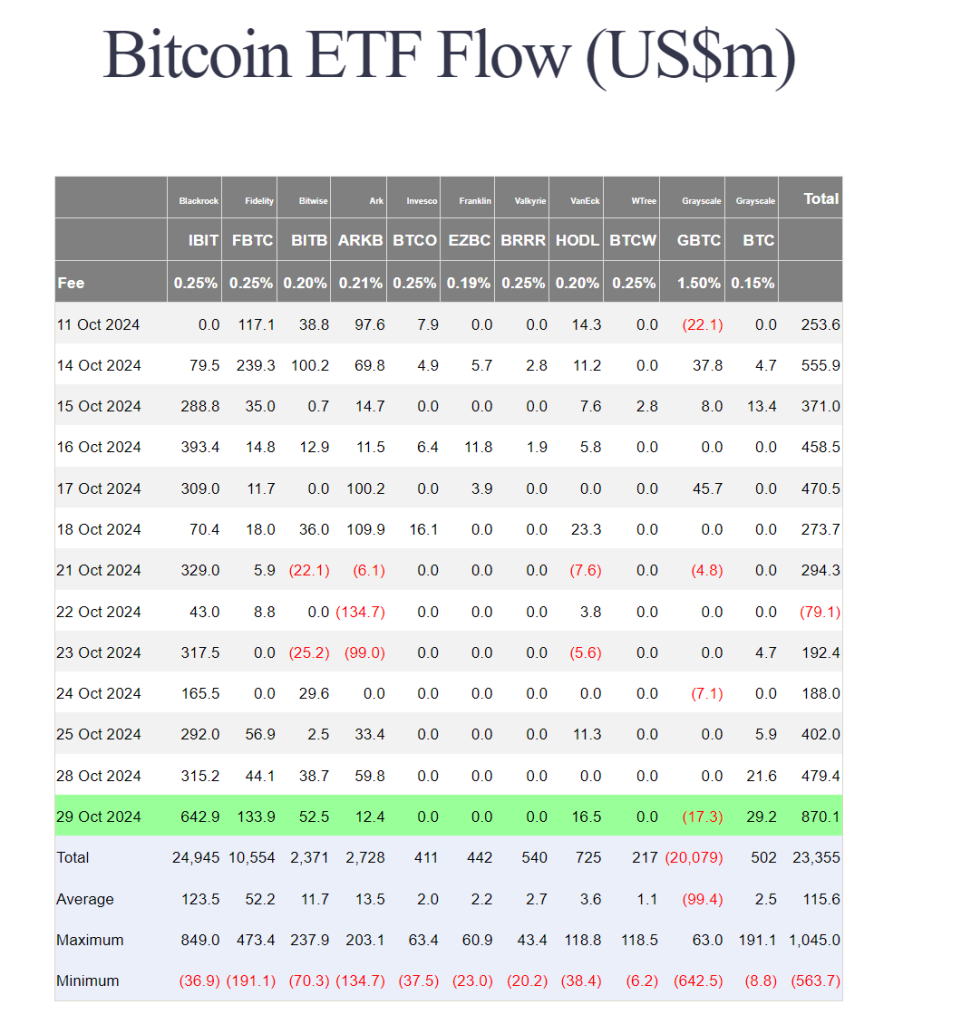

Bitcoin’s recent climb toward historic highs has generated strong interest from institutional investors. Major players, rather than retail investors, appear to be fueling this rally, with considerable inflows into Bitcoin-focused exchange-traded funds (ETFs). For example, firms like BlackRock have reported notable trading volumes in Bitcoin ETFs throughout late October, further reinforcing Bitcoin’s role as a favored institutional asset. Despite Bitcoin’s notable rally, public interest remains comparatively low. Search data, for instance, shows that “Bitcoin” is currently generating far less attention than buzzworthy topics like “AI,” suggesting retail investors may only join the market later, potentially amplifying Bitcoin’s upward momentum as they do.

Is an Altseason on the Horizon? Here’s Why Altcoins Could Soon Take Off

As Bitcoin’s dominance — its market share relative to other cryptocurrencies — reaches high levels, discussions around an upcoming altseason have intensified. Historically, significant Bitcoin price increases are often followed by capital rotation into altcoins, where investors diversify in search of higher returns. This shift presents substantial growth opportunities for altcoins and opens doors for new projects, enabling them to capture capital flows as investors look beyond Bitcoin.

High Bitcoin dominance may signal that a shift is imminent. As investors seek alternative assets with higher growth potential, altcoins could see a resurgence, potentially accelerating the launch of new blockchain projects and assets that offer diversified opportunities within the crypto space.

Emerging Blockchain Projects: Why Altseason Could Be a Game-Changer

A flourishing altseason could pave the way for innovative blockchain projects, especially those that combine technology with real-world applications. As capital flows from Bitcoin to altcoins, initiatives that provide tangible value, such as real estate tokenization, are likely to capture investor interest. With an increased appetite for portfolio diversification, investors may turn to asset-backed tokens and altcoins, particularly those that align with current trends toward innovation and real-world utility.

Projects like NOVA Real Chain — focused on the tokenization of real-world assets — could be well-positioned to benefit in this scenario. By offering a way to invest in tokenized assets like real estate, NOVA Real Chain taps into the demand for alternative assets during altseason, providing investors a bridge between digital and tangible value in the growing crypto ecosystem.

The Future of Crypto: Will Altcoins and Bitcoin Share the Stage?

Bitcoin’s approach to a new all-time high, driven by institutional backing, paints an optimistic outlook for the broader crypto market. As the prospect of an altseason looms, investors may find new opportunities outside of Bitcoin, particularly in projects that harness blockchain for practical use cases. The market’s drive for diversification positions this potential altseason as an exciting period for both established assets and innovative projects, underscoring a dynamic future for the cryptocurrency landscape.