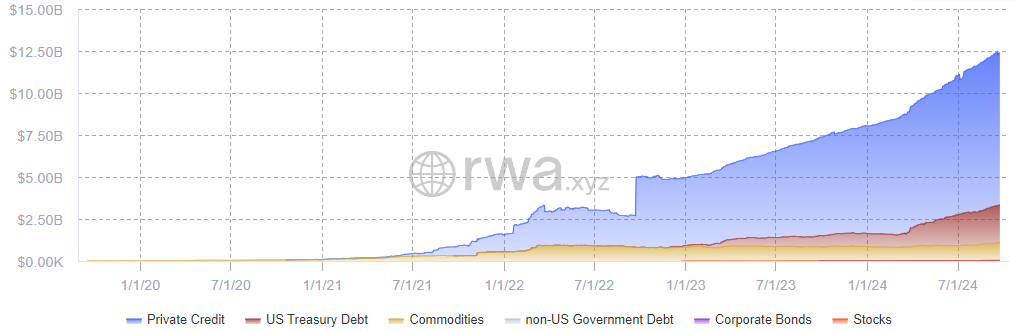

Tokenized real-world assets (RWAs) have skyrocketed, with the market now exceeding $12 billion in capitalization. This rapid expansion highlights the transformative potential of blockchain technology, enabling the tokenization of physical assets such as real estate, government securities, luxury goods, and private equity. This process allows investors to own and trade portions of tangible assets through a decentralized and transparent platform, bringing traditional finance into the world of digital assets.

The Growing Popularity of RWAs in DeFi

The rise of tokenized RWAs in decentralized finance (DeFi) can be attributed to a shift in investment preferences during the 2022-2023 market downturn. As traditional finance (TradFi) bond yields began to surpass those of low-risk DeFi offerings, U.S. Treasurys, in particular, became attractive due to their stability and favorable returns. In response, several blockchain protocols began offering tokenized versions of these assets, such as U.S. Treasurys and private loans, allowing investors to access real-world financial products on-chain.

With U.S. Treasury yields ranging from 5% to 5.24%, DeFi protocols offering returns between 3.73% and 7.46% on stablecoins appeared less competitive. This led to a surge in demand for tokenized RWAs, providing investors with the security of traditional assets and the efficiency of blockchain technology.

Institutional Interest Drives Market Growth

The current capitalization of $12 billion reflects increased institutional involvement and the broader adoption of RWA tokenization. Major financial institutions like BlackRock have embraced the space, with BlackRock’s BUIDL fund growing to over $462 million in market cap. These developments signal a shift in how traditional financial products are being integrated into the digital asset ecosystem.

The performance of RWA tokens has also outpaced many major cryptocurrencies, making them an attractive option for investors looking for stable, risk-adjusted returns. This success underscores the growing role that tokenized real-world assets will play in shaping the future of both traditional finance and blockchain-based markets.

NOVA Real Chain: A Competitive Force in the RWA Market

NOVA Real Chain is at the forefront of this revolution, offering a competitive edge with a diverse range of tokenized products. By providing access to real-world assets like real estate, luxury cars, and RWA nodes, NOVA Real Chain allows users to invest in assets that generate passive income. Whether it’s the rental income from tokenized real estate, the appreciation of luxury vehicles, or the rewards from nodes, NOVA Real Chain presents a unique opportunity for investors seeking both stability and growth.

With a well-structured marketplace, NOVA Real Chain connects users with tokenized assets that combine the security of traditional investments with the flexibility and efficiency of blockchain technology. This approach positions NOVA Real Chain as a key player in the evolving RWA market, providing a comprehensive platform for those looking to diversify their portfolios with real-world asset-backed investments.

Conclusion

The surge in tokenized real-world assets reflects a growing trend towards blending traditional finance with the transparency and efficiency of blockchain. With the RWA market now surpassing $12 billion, and platforms like NOVA Real Chain offering a diverse range of income-generating products, the future of tokenization is poised to transform the financial landscape. Investors seeking stable, passive income through digital assets are finding a wealth of opportunities in this rapidly expanding space.